Tax

How to Update Your Citizen ID to Tax Identification Number on eTax Mobile

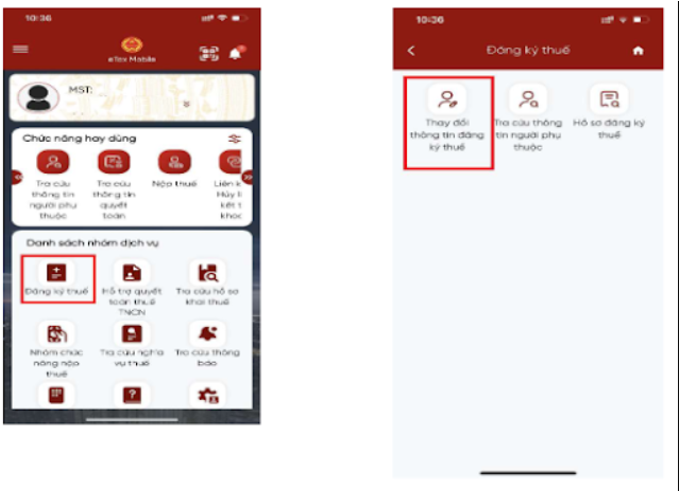

Starting from July 1, 2025, the personal identification number (12-digit Citizen ID or National ID code) will officially replace tax codes for individuals, households, and household businesses nationwide. This aims to synchronize tax system data with the National Population Database, increase transparency, and reduce administrative procedures. 🛠 Step-by-Step Guide on eTax Mobile Step 1: Log […]

6. Determining personal income tax payers in cases other than salary and wages

✅ Individuals with business income: If only one person is named in the Business Registration Certificate → The taxpayer is the named person.If multiple people are named → Each named individual must pay tax.If a household has multiple business people but only one person is named → The named person is the taxpayer.If doing business […]

5. Key points to note for applicable tax exemptions

Points to Note: Handling taxes for individuals on business trips before they become official legal representatives Some businesses expanding to Vietnam may assume that non-residents are not obligated to pay taxes. However, non-residents are still subject to a fixed tax rate of 20%. (This tax rate only applies to income originating in Vietnam, not the […]

4. How to calculate personal income tax (PIT)

The formula for calculating PIT in Vietnam is as follows: (1) Taxable income = Total income – Tax-exempt income(2)Assessable income = Taxable income – Deductions(3) Personal income tax payable = Assessable income × Progressive tax rate *Deductions include = Personal deduction + Dependent deduction + Insurance deductions + etc +Personal deduction: 11 million VND/month+Dependent deduction: […]

3. Applicable tax rates and personal income tax table

Personal income tax rates in Vietnam depend on the residency status: Residents: Progressive tax rates apply (see the table below). Non-residents: A fixed tax rate of 20% applies. Progressive Tax Schedule This tax schedule applies to income from business, salaries, and wages, including total taxable income as stipulated in Articles 10 and 11 of the […]

2. Scope of taxable personal income

– Resident individuals: Taxed on their worldwide income, regardless of the source of payment. – Resident individuals from countries with a double taxation avoidance agreement: Taxed only from the first month of entry to the month of contract termination and departure from Vietnam, without the need for consular confirmation procedures. – Non-resident individuals: Taxed only […]

1. Definition of resident and non-resident Individuals – Who is subject to tax?

1.1 What is a Resident Individual? An individual is considered a resident in Vietnam if they meet one of the following conditions: a. Duration of Stay:Present in Vietnam for 183 days or more in a calendar year or within 12 consecutive months from the date of entry. (Both the arrival and departure days are counted […]

Guide to Self-Settlement of Personal Income Tax for 2025 on the eTax Mobile Application

Guide to Self-Settlement of Personal Income Tax for 2025 on the eTax Mobile Application 1. Download and Log in to eTax Mobile 2. Prepare the Tax Settlement Declaration 3. Determine the Tax Authority for Submitting the Declaration 4. Enter Income Information and Deductions 5. Submit the Declaration Note: You are required to self-settle personal income […]

Overview of Personal Income Tax (PIT) in Vietnam

Overview of Personal Income Tax (PIT) in Vietnam Personal income tax (PIT) in Vietnam applies not only to Vietnamese workers but also affects foreigners (including Japanese) working in Vietnam, expatriates dispatched to Vietnam (including from Japan), employees recruited in Vietnam, and even short-term business trips. Therefore, understanding the tax system is crucial for both businesses […]