Guide to Self-Settlement of Personal Income Tax for 2025 on the eTax Mobile Application

Date: 2025.04.17

Guide to Self-Settlement of Personal Income Tax for 2025 on the eTax Mobile Application

- If you have income from wages and salaries in 2024, this is the time to fulfill your personal income tax settlement obligations as per the Tax Administration Law.

- To facilitate employees, the tax authority has upgraded the eTax Mobile application, allowing taxpayers to easily perform the steps of preparing and submitting tax settlement declarations directly on their phones quickly and conveniently.

- Deadline for submitting personal income tax settlement reports for self-settlement individuals: by May 5, 2025.

- The following article by Help All will provide detailed instructions on how to self-settle personal income tax for 2024 using the eTax Mobile application with declaration form 02/QTT-TNCN:

1. Download and Log in to eTax Mobile

- Download the latest version of the eTax Mobile application from Google Play or the App Store.

- Log in using your tax code and password, or use your VNeID account.

2. Prepare the Tax Settlement Declaration

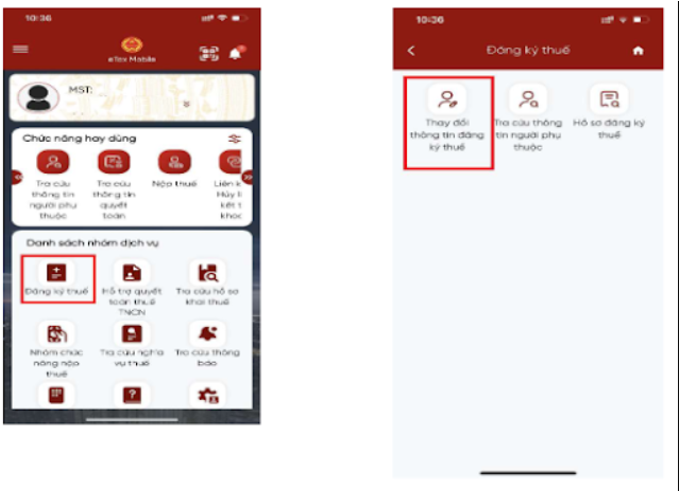

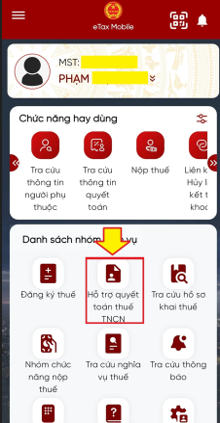

- On the main interface, select “Personal Income Tax Settlement Support” → “Support for Preparing Settlement Declaration”.

- The screen will display the tax code and allow you to select the settlement year 2024 → click “Search”.

- Click “Create Suggested Declaration 02/QTT-TNCN”, then fill in the required information such as:

+ Type of declaration.

+ Declaration year.

+ Settlement case.

+ Period from month… to month…

3. Determine the Tax Authority for Submitting the Declaration

- The system will automatically suggest the appropriate tax authority based on personal information and type of income.

- At this point, you need to check and review your personal information.

4. Enter Income Information and Deductions

- Click Continue, the system will display the declaration screen with fields from [20] to [48], allowing data modification.

- The taxpayer reviews and updates the fields if there are any differences from the actual data.

- If there are dependents, declare them in the 02-1/BK-QTT-TNCN schedule.

- Click Continue, the system will move to the Tax Settlement Support Information screen and save the dependent information in the 02-1/BK-QTT-TNCN schedule.

5. Submit the Declaration

- After completing the above steps, the system will display the completed declaration.

- Review the information, attach the necessary appendices, and confirm submission using the OTP sent to your phone.

- Continue, the system will display the OTP entry screen sent to the taxpayer’s phone number.

- Select Confirm, the system will display a successful declaration submission notification.

Note:

You are required to self-settle personal income tax if you fall into one of the following four cases:

- You have additional tax payable or excess tax paid, and need to request a refund or offset it against the next period.

- You have income from wages or salaries from abroad or international organizations in Vietnam that have not withheld tax.

- You are a foreigner who has ended your employment contract in Vietnam and is preparing to leave the country.

- You are an individual eligible for tax reduction due to natural disasters, fires, accidents, or serious illnesses.

Source: thuvienphapluat

#HelpAll #Assistant #YourAssistant #バックオフィス代行 #BackOfficeOutsourcing